Simpl :

Streamlined ESG reporting platform

Simpl’s SaaS platform is structured around a three-step process—data collection, processing, and analysis— tailored specifically for the infrastructure sector. We integrate three key frameworks to enhance your reporting capabilities, created to fit infrastructure-specific analysis:

Simpl :

Streamlined ESG reporting platform

Simpl’s SaaS platform is structured around a three-step process—data collection, processing, and analysis— tailored specifically for the infrastructure sector. We integrate three key frameworks to enhance your reporting capabilities, created to fit infrastructure-specific analysis:

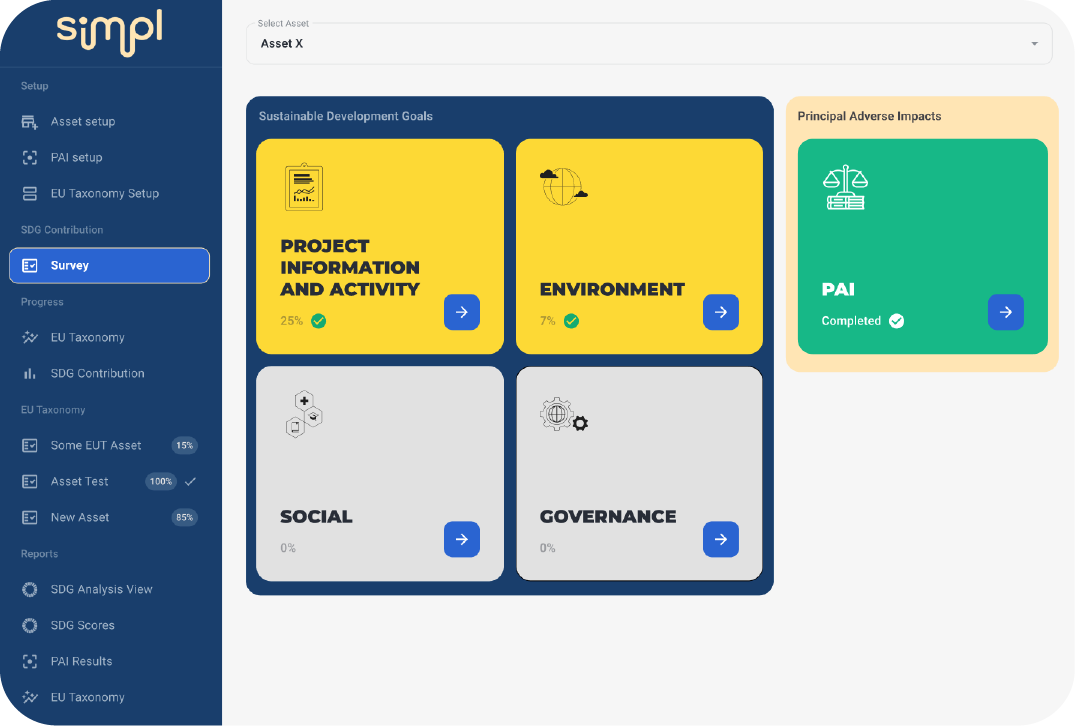

Sustainable development

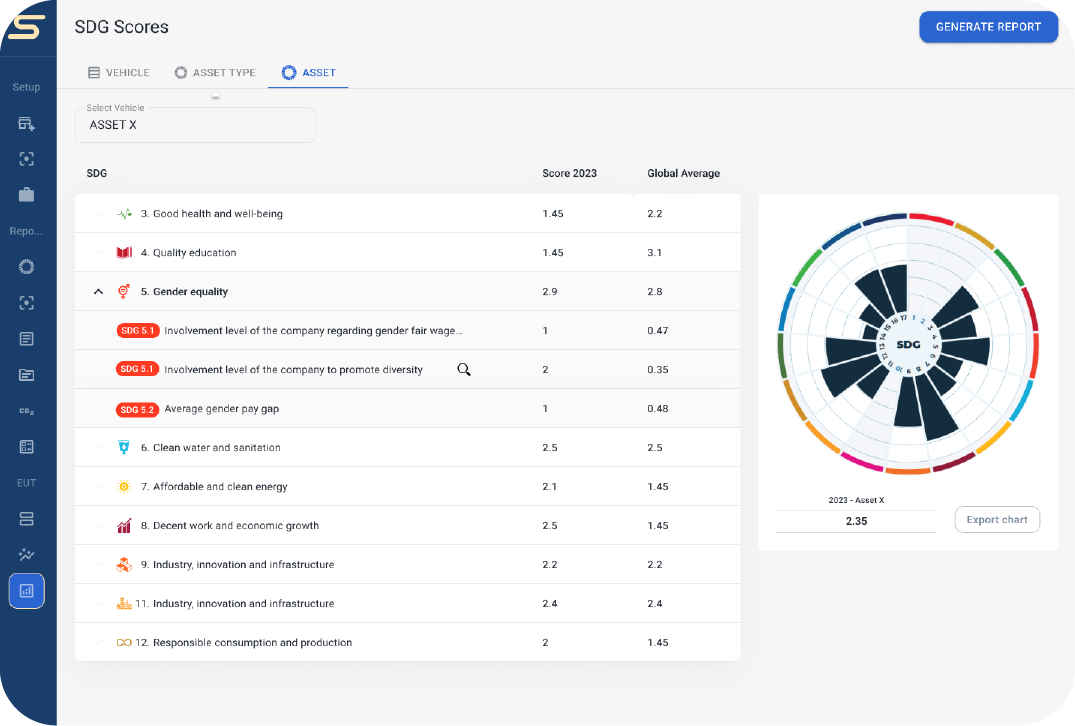

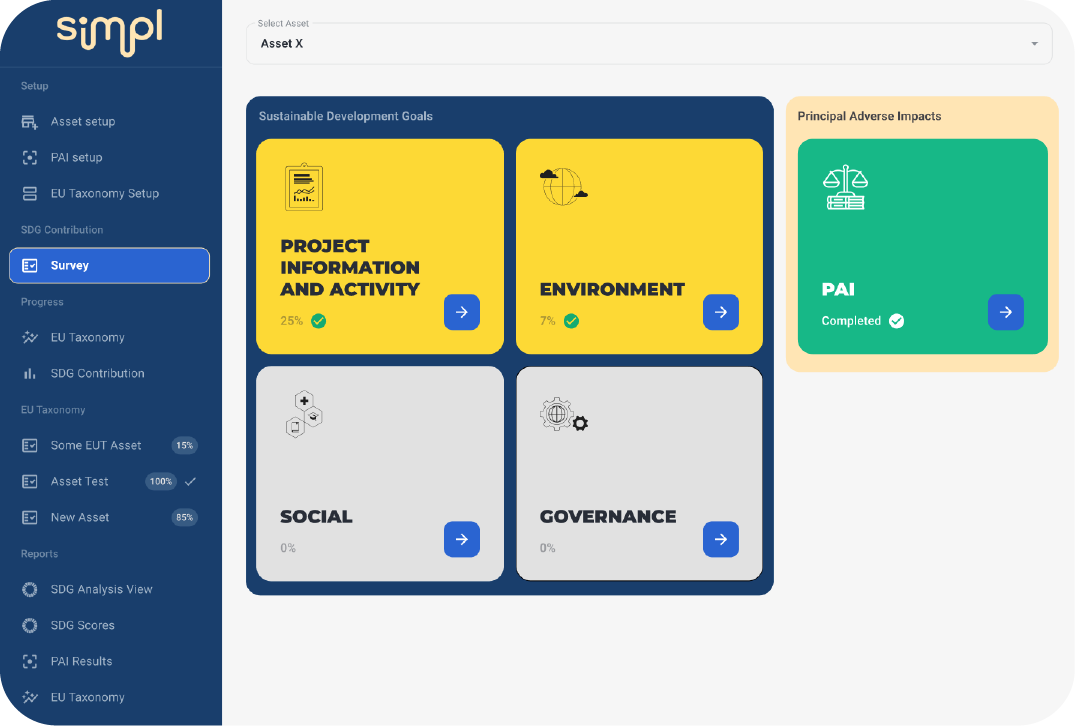

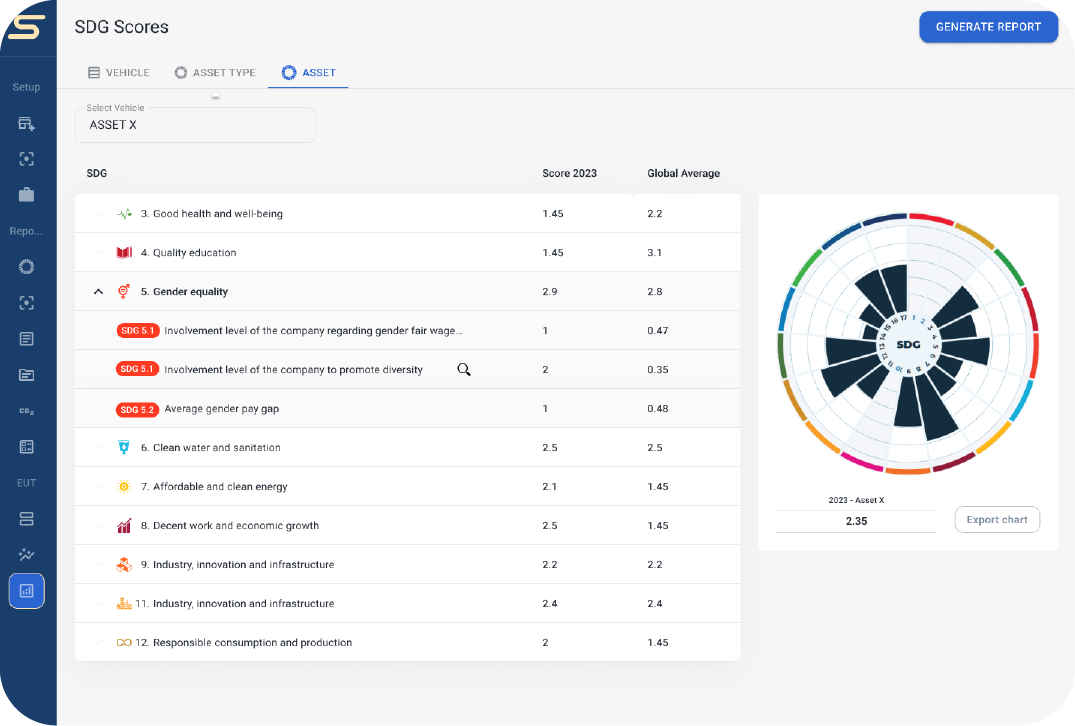

goals (SDG) alignment

Our platform enables infrastructure assets to be assessed for their contribution to the Sustainable Development Goals. Simpl assigns scores to assets for their alignment with SDGs by benchmarking them against industry peers and allows the aggregation of these results by asset type, fund or company. This allows for a comprehensive view of how your projects contribute to global sustainability objectives. The platform also facilitates year-to-year performance evaluations, helping you measure progress and compare it against industry peers.

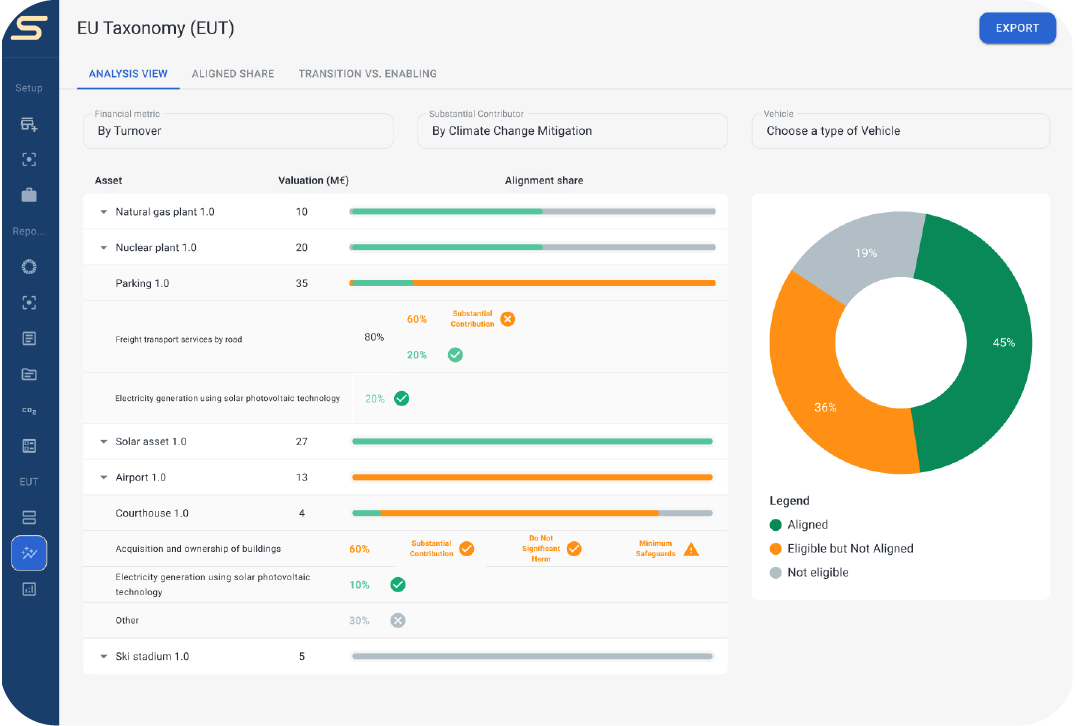

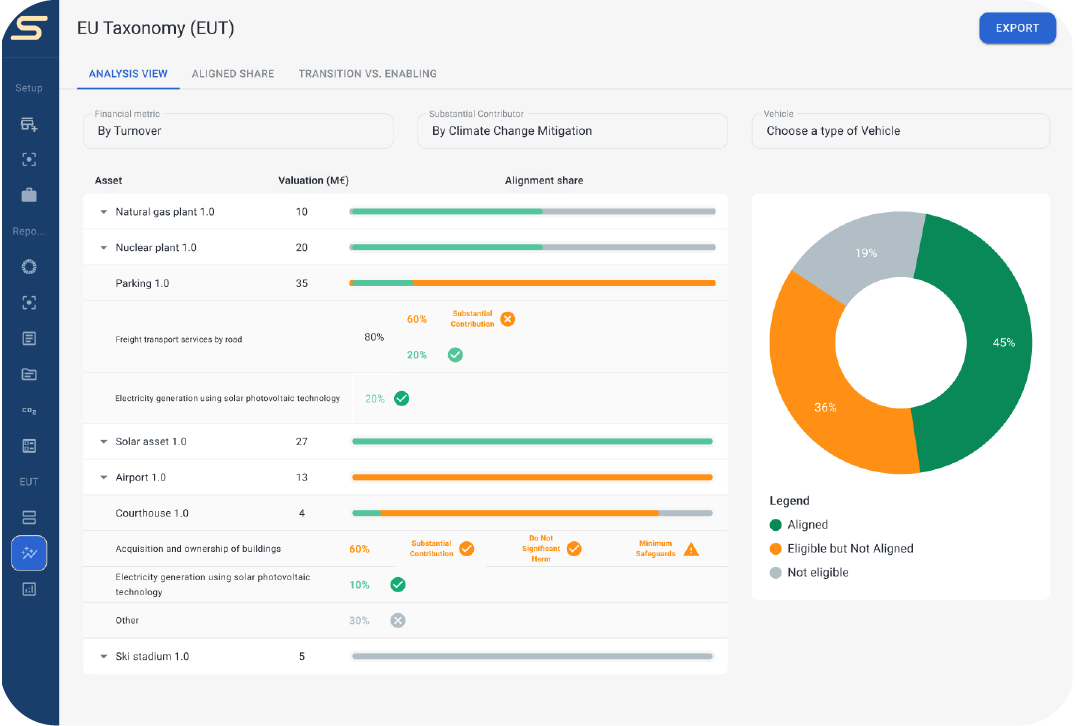

EU taxonomy compliance

Simpl facilitates the assessment of your portfolio’s alignment with the EU Taxonomy standards. Our module helps you quickly determine eligibility and alignment by performing calculations across multiple indicators. This not only speeds up the process but also enhances accuracy and allows for the identification of non-aligned assets and opportunities for improvement.

SFDR principal adverse

impact (PAI) statements

The platform streamlines the calculation of PAI indicators and supports customised voluntary indicators tailored to specific assets and funds. Simpl provides real-time insights and user-friendly visualisations, making it easier to monitor and report on Principal Adverse Impacts as required by the Sustainable Finance Disclosure Regulation (SFDR).

Sustainable development goals (SDG) alignment

Our platform enables infrastructure assets to be assessed for their contribution to the Sustainable Development Goals. Simpl assigns scores to assets for their alignment with SDGs by benchmarking them against industry peers and allows the aggregation of these results by asset type, fund or company. This allows for a comprehensive view of how your projects contribute to global sustainability objectives. The platform also facilitates year-to-year performance evaluations, helping you measure progress and compare it against industry peers.

EU taxonomy compliance

Simpl facilitates the assessment of your portfolio’s alignment with the EU Taxonomy standards. Our module helps you quickly determine eligibility and alignment by performing calculations across multiple indicators. This not only speeds up the process but also enhances accuracy and allows for the identification of non-aligned assets and opportunities for improvement.

SFDR pincipal adverse

impact (PAI) statements

The platform streamlines the calculation of PAI indicators and supports customised voluntary indicators tailored to specific assets and funds. Simpl provides real-time insights and user-friendly visualisations, making it easier to monitor and report on Principal Adverse Impacts as required by the Sustainable Finance Disclosure Regulation (SFDR).

Discover more with a demo

See how Simpl can specifically enhance your ESG reporting efforts by requesting a personalised demo. Our experts will walk you through the capabilities of our platform and demonstrate how it can be adapted to your specific requirements.

Discover more with a demo

See how Simpl can specifically enhance your ESG reporting efforts by requesting a personalised demo. Our experts will walk you through the capabilities of our platform and demonstrate how it can be adapted to your specific requirements.